do you have to pay inheritance tax in arkansas

In 2021 the current federal estate exemption is 117 million but you could end up losing your money to taxes if you dont plan appropriately. This does not mean however that Arkansas residents will never have to pay an inheritance tax.

What Happens After Probate Is Closed Probate Advance

If you inherit property you dont have to pay a capital gains tax until you sell the plot.

. Like the Federal estate tax laws Louisianas inheritance tax laws have undergone a lot of changes in the past several years. Retirees hoping to pass on some of their wealth to the next generation can do so tax-free at least at the state level. This gift-tax limit does not refer to the total amount you can give within a year.

Arkansas state income tax rates range from 0 to 59. Thats because federal law. 08 percent to 16 percent on estates above 1 million.

Do you have to pay inheritance tax in Arkansas. Arkansas does not collect inheritance tax. How much is US inheritance tax.

The laws regarding inheritance tax do not depend on where you as the heir. The annual exemption limit for 2022 is 16000 This means that there is no tax on gifts that do not exceed this amount. Learn about Arkansas income property and sales tax rates to estimate what youll pay on your 2021 tax return.

Strictly speaking it is 0. I inherited from my brother in law who passed a - Answered by a verified Tax Professional. Inheritance taxes can apply regardless of whether the deceased person had a Louisiana Last Will and Testament or died intestate.

The inheritance laws of another state may apply to you if you inherit money or property from a person that lives in a state that has an inheritance tax. Estate tax of 08 percent to 16 percent on estates above 5 million. Do you have to pay taxes on inheritance money.

This might not help you avoid inheritance taxes but it will lessen your estate taxes. It is true that there is no federal inheritance tax but there is a federal estate tax. The laws regarding inheritance tax do not depend on.

The Federal Gift Tax has an annual exemption which allows you to. The first rule is simple. Arkansas also does not have a gift tax.

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. All Major Categories Covered. However an Arkansas resident who has 13 million worth of estate cannot just gift away 940000 at once and forget about it.

Few taxpayers have to pay federal estate taxes but may be billed by 17 states and the District of Columbia that tax inheritances andor estate assets. On the other hand Arkansas does not have an estate or inheritance tax. So if you have investments in assets outside of a retirement account and they gain value keep in mind you will pay income taxes on most of those gains.

If you receive property in an inheritance you wont owe any federal tax. If you inherit property you dont have to pay a capital gains tax until you sell the plot. Arkansas does not have a state inheritance or estate tax.

Arkansas also does not have a gift tax. There is no federal inheritance taxthat is a tax on the sum of assets an individual receives from a deceased. Arkansas does not have an inheritance tax.

Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. You would receive 950000.

Do you have to pay taxes on inheritance money. According to the 2021 House Price Index the average property value in the UK is 256405 which could easily push an estate above the 325000 threshold when combined with other assets. It allows the states residents simply gift away the taxable parts of their estates and protect their inheritance.

There is no federal inheritance tax. Select Popular Legal Forms Packages of Any Category. Inheritance tax of up to 10 percent.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. Arkansas also does not assess an inheritance tax which is the second type of tax seen at the state level. Inheritances that fall below these exemption amounts arent subject to the tax.

An inheritance tax is a tax imposed on someone who inherits money from a deceased person. You can give as much as 16000 to one person. Although Arkansas does not require you to pay an inheritance or estate tax youre not exempt from paying them entirely.

What Happens After Probate Is Closed Probate Advance

Estate And Inheritance Tax State By State Housing Gurus

Death Bitcoin And Taxes A Guide To Post Life Crypto The Hustle

Death Bitcoin And Taxes A Guide To Post Life Crypto The Hustle

Death Bitcoin And Taxes A Guide To Post Life Crypto The Hustle

Problems When Two Siblings Inherit A House Probate Advance

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

Do You Pay Taxes On A Life Insurance Payout Jrc Insurance Group

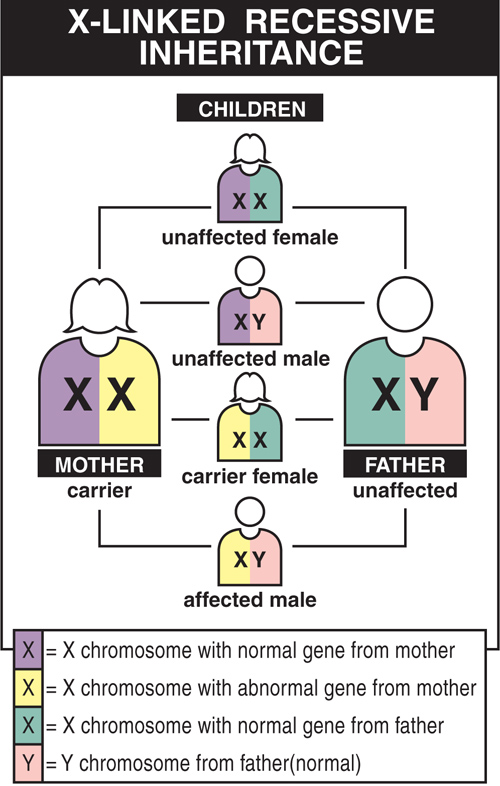

Causes Inheritance Duchenne Muscular Dystrophy Dmd Diseases Muscular Dystrophy Association

Estate Planning Strategies To Reduce Estate Taxes Trust Will

Death Bitcoin And Taxes A Guide To Post Life Crypto The Hustle

Selling A House You Inherited In Arkansas A Full Guide 365 Property Buyers

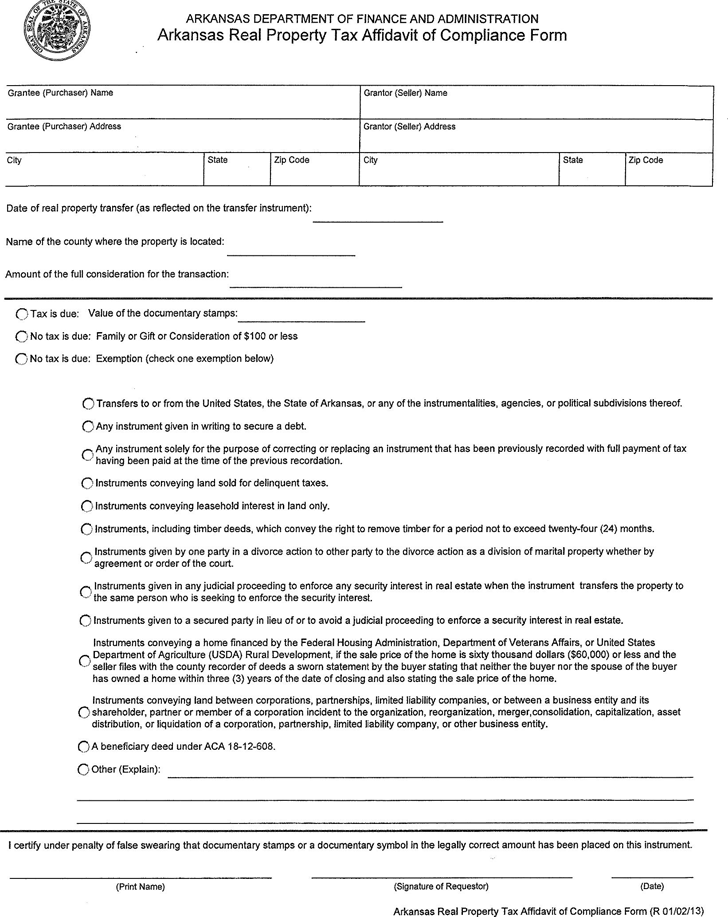

Free Arkansas Real Property Tax Affidavit Of Compliance Form Pdf 84kb 1 Page S

Creating Racially And Economically Equitable Tax Policy In The South Itep

Each State Has Its Own Rules Governing Estate Taxes The Washington Post

Creating Racially And Economically Equitable Tax Policy In The South Itep

What Power Does An Executor Of A Will Have Lawrina

Creating Racially And Economically Equitable Tax Policy In The South Itep